Considered an “essential life skill,” but still blissfully ignored by many, the lack of financial literacy is the cause of many societal issues that exist in the United States today. Awareness of the topic is the key to fixing some of these issues, especially in young adults. More schools every year include a course on financial literacy as a graduation requirement. According to Next Gen Personal Finance, 22.7% of schools have implemented some sort of educational variable with financial literacy being the main focus. This means that almost 1 in every 4 students are coming out of the American Public School System with the opportunity to be more educated on the topic. However, this is nowhere near enough to consider it a success. Every student should have the chance to learn “real-life skills” within our education system to ensure success for our future as a generation.

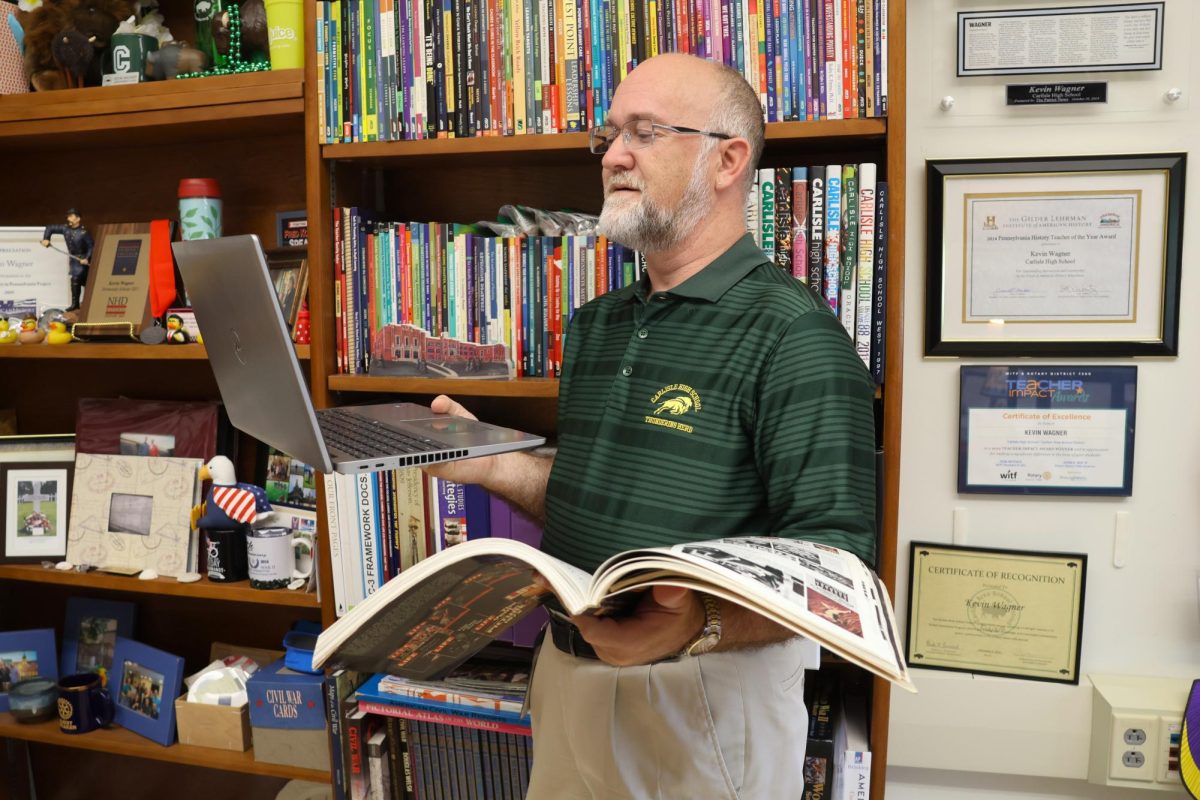

I first interviewed Mr. Bond, Carlisle’s very own financial literacy teacher, is a CHS graduate that has completed further education in the business field at Shippensburg University. Mr. Bond primarily teaches 11th graders at Carlisle High School. He defines financial literacy as the knowledge to “navigate personal finances, including banking, investing, and retirement.” My second interview was with a well-known Carlisle entrepreneur who owns five different companies under the umbrella of Neidlinger Enterprises LLC, Rob Neidlinger. He is an advocate in teaching his social media followers about financial advice and investment opportunities. He said there is not one particular definition for this topic – “financial literacy is learning to save a certain amount of money of what you make, needs to be saved… and not touched.”

Both interviewees describe how most of their knowledge about financial literacy came from their personal experiences in life. Mr. Bond explains that teaching financial literacy to 11th graders is ideal because they haven’t yet made financial mistakes, allowing them to start on the right foot. Rob says something similar to this, claiming that if a younger person were to hear the conversation we were having, it could make a big difference in their life. The common theme between these two points is that the younger you are, the better it is to learn. Rob even shared some information about his younger daughters and their spending habits. He has three daughters; one being 14, one being 6, and the youngest being 5. He focuses on the younger children in the conversation, stating, “I mean, my five and six-year-old came up to me the other day and said ‘I have money and we’re spending it.’ Like, literally, they were flashing it, because they know I am always telling them to save money and they like to brag that they’re going to spend all of their money. I think eventually they will understand.”

Now you may be thinking: Great, but how does this apply to me? Personal experience is the best teacher anyone can have, but listening to other people’s first hand experiences is so beneficial. As I speak to Rob, he provides an example that he has seen first hand with a friend: You just graduated high school and went through the VO TECH program, so you have some work experience in your field. While on a job search, you find a great opportunity with great pay rates… a dream come true, right? “They’re making good money. They’re now buying a car with this money. They find this nice truck. I come from Big Spring, so you know, kids at Big Spring drive trucks, right? Then they have a $1,000 car payment, but they’re making good money, they tell themselves, and they deserve the truck. The problem is the truck’s not really going up in value and it’s really a bad investment.” While this does not seem like a big deal to most, he explains this investment can set you back years. His solution: “They should be buying a 15-year-old Honda Accord with 150,000 miles on it that they could buy for $3,000 and not have a loan on it. Now they can have that $1,000 a month going towards retirement.” He also later admitted that he went through a similar experience, and this scenario is quite common for a lot of young adults entering the job field.

At a young age, things like retirement and times to invest seem far away and it gets put on the “to-do later” list. In reality, the earlier you start this process, the more financially comfortable you may be in the future. I had asked Rob after this conversation, “what is the thing that should be someone’s first investment?” He responded by explaining everyone has a different path to investment. Yes, there are solid first investments like Roth IRAs and Retirement funds, which Mr. Bond claims that the curriculum does require. However, it must be acknowledged that financial situations have so many factors that there is not one way to financial success, ever.

As I wrapped up my conversation with Mr. Bond, we talked about some revisions to the curriculum that could be made so students can get the full benefit. “I feel like I could easily double it and get more, like, a little bit more into depth and allow more, maybe, hands on, but I think it is a nice overview. It’s probably long enough to hold students’ attention without getting, like, too deep, but I think we can easily double it.” The lack of opportunity to learn about this to a higher extent is concerning for our generation as we go through things such as inflation and the national debt increasing daily. There are many things we can do as a society to make this a priority in our education and knowledge. My hope is that eventually, this topic will become common knowledge to young adults and their confidence level will increase going into the “real world.”